You can master the latest information, new product , exhibition, promotion, etc

In recent years, a growing number of countries have implemented comprehensive bans on disposable vapes, marking a significant shift in global tobacco product regulation. Since early 2025, France (effective February 25), the UK and Wales (effective June 1), and several Central Asian nations including Kyrgyzstan, Uzbekistan, and Kazakhstan have successively prohibited the production, sale, and use of disposable vaping products. The European Union is set to extend the ban to flavored vapes by 2026, while China has maintained strict oversight of the entire vaping industry chain since 2021. For foreign trade enterprises engaged in the vaping sector, these regulatory changes have brought severe challenges to export business, making the search for compliant and sustainable alternatives more urgent than ever.

Core Drivers Behind the Global Disposable Vape Bans

The widespread ban on disposable vapes is not a sudden decision but a response to pressing public health and environmental concerns, supported by compelling data and research findings:

Public Health Risks, Especially for Adolescents

The World Health Organization (WHO) released its first global report on e-cigarette use in 2025, warning that e-cigarettes are fueling a "shocking new wave of nicotine addiction," with at least 15 million adolescents aged 13-15 worldwide using vaping products. Data shows that the probability of adolescents using e-cigarettes is 9 times higher than that of adults on average in countries with available statistics. In the UK, nearly a quarter of 11-15-year-olds have tried e-cigarettes, and 10% use them frequently; in France, 15% of 13-16-year-olds have used disposable vapes. Governments around the world aim to curb youth nicotine dependence by banning disposable vapes, which are often favored by young people for their low cost, portability, and diverse flavors.

Severe Environmental Pollution and Safety Hazards

Disposable vapes have become a major environmental hazard due to their non-recyclable components, including lithium batteries, plastic casings, and nicotine-containing e-liquid. In the UK alone, approximately 8.2 million disposable vapes are discarded every week, equivalent to 13 per second, and these discarded products have caused a surge in fires at waste recycling facilities. A single year of properly recycling all discarded disposable vapes in the UK could provide lithium for over 10,000 electric vehicles, highlighting the waste of resources inherent in disposable designs. The flammable lithium batteries in these products also pose significant safety risks during transportation and disposal, further prompting governments to take regulatory action.

Compliant Alternatives to Disposable Vapes: Navigating the New Regulatory Landscape

For foreign trade enterprises looking to maintain market share amid tightening regulations, developing and promoting compliant alternatives is the key to survival and development. Based on current global market trends and regulatory requirements, the following alternatives have shown strong potential and feasibility:

1. Reusable and Refillable Vape Devices

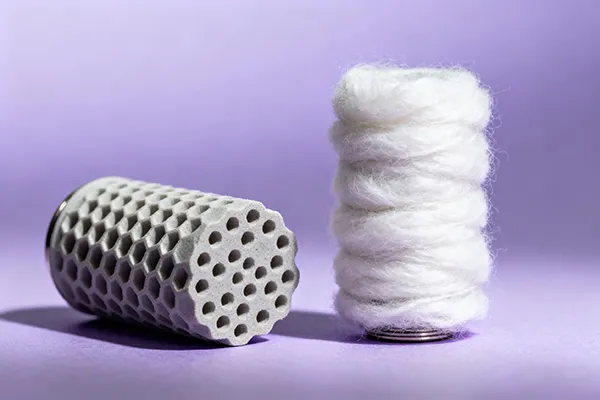

Reusable vape devices, including pod-based systems and open-tank mods, have emerged as the most direct and mature alternative to disposable vapes. These devices feature replaceable pods or refillable tanks, significantly reducing environmental waste compared to disposable products. Technological advancements have improved the performance of reusable devices: ceramic atomizer cores, which have a penetration rate of over 80% in the market, increase atomization efficiency by 30% and reduce harmful substance emissions to less than 5% of those from traditional cigarettes.

To ensure compliance in global markets, reusable devices must meet regional regulatory standards. For example, products entering the EU market must comply with the Tobacco Products Directive (TPD), which limits nicotine concentration to ≤20mg/mL and single pod capacity to ≤2mL, and requires child-resistant packaging and detailed ingredient disclosure. In the US, manufacturers need to complete the Premarket Tobacco Product Application (PMTA) process to obtain market access. Despite higher initial R&D and certification costs, reusable devices offer long-term market stability and align with the sustainable development trends favored by regulators.

2. Heat-Not-Burn (HNB) Tobacco Products

Heat-not-burn (HNB) products, which heat tobacco to 250-350℃ (well below the 600℃+ combustion temperature of traditional cigarettes) to release nicotine and aerosol without open flames, have become a core segment of the new tobacco market. Compared to traditional cigarettes, HNB products reduce harmful substances such as tar and carbon monoxide by 90%-95%, while retaining the original tobacco flavor, making them an attractive option for adult smokers seeking reduced-harm alternatives.

Globally, HNB products have gained regulatory acceptance in many regions. In China, HNB has been classified as a cigarette product and brought under tobacco monopoly supervision since 2019; in 2025, China launched a pilot program for importing HNB devices, with tobacco pods distributed through the state-owned tobacco system, forming a "device open, pod controlled" transition model. In Japan, IQOS (a leading HNB brand) has obtained regulatory approval and achieved significant market penetration. For foreign trade enterprises, HNB products represent a high-growth alternative, though they require adherence to strict regional production and sales regulations, including tobacco raw material control and product certification.

3. Oral Nicotine Products

Oral nicotine products, such as nicotine pouches, lozenges, and gums, have emerged as a promising alternative for adult nicotine users seeking smoke-free and vapor-free options. These products do not produce second-hand smoke or environmental waste, making them compliant with most smoke-free regulations and environmental policies. Unlike vapes, oral nicotine products do not require electronic components or batteries, reducing transportation risks and regulatory scrutiny related to electronic devices.

The global oral nicotine market is growing rapidly, driven by increasing demand for discreet and convenient nicotine delivery methods. However, manufacturers must ensure compliance with regional standards for nicotine content, packaging labels, and sales restrictions to minors. For example, in the EU, oral nicotine products must comply with the TPD’s general requirements for tobacco products, while in the US, they are regulated by the Food and Drug Administration (FDA).

Strategic Recommendations for Foreign Trade Enterprises in the Post-Ban Era

Faced with the global wave of disposable vape bans, foreign trade enterprises in the vaping industry need to adjust their business strategies proactively to adapt to the new regulatory environment:

First, strengthen compliance layout. Enterprises should closely track regulatory updates in target markets, including ban scopes, certification requirements, and labeling standards, and cooperate with authoritative testing institutions to obtain necessary certifications such as EU TPD, US PMTA, and China’s tobacco monopoly license. For non-EU enterprises, appointing an EU-authorized representative is essential to handle compliance matters efficiently.

Second, accelerate product innovation and transformation. Allocate resources to R&D of reusable vapes, HNB products, and oral nicotine alternatives, focusing on improving product safety, environmental performance, and user experience. Leverage technological advancements such as smart vaping devices and low-harm atomization technologies to enhance market competitiveness.

Third, optimize market diversification. Reduce reliance on single markets with strict bans and explore emerging markets with more favorable regulatory policies. For example, while the EU and Central Asian markets have tightened regulations, some Southeast Asian and Latin American countries are still in the early stages of vaping regulation, offering potential growth opportunities.

Conclusion: Embracing Change for Sustainable Development

The global wave of disposable vape bans reflects the growing emphasis on public health and environmental protection worldwide, and it also marks the transition of the vaping industry from barbaric growth to standardized development. For foreign trade enterprises, this is both a challenge and an opportunity. By focusing on compliant alternatives such as reusable vapes, HNB products, and oral nicotine solutions, and adhering to the principles of health, environmental protection, and regulatory compliance, enterprises can navigate the complex regulatory landscape and achieve long-term and stable development in the global market.

As the industry evolves, continuous attention to policy updates and technological innovation will be the key to maintaining competitiveness. The future of the global vaping industry lies in balancing product innovation with social responsibility, and only enterprises that can adapt to regulatory changes and meet consumer demand for safer, more sustainable products will thrive in the new era.